michigan gas tax increase history

Gasoline 272 per gallon. The gas tax will rise by 56 cents per gallon under the last stage of an increase approved by lawmakers in 2017As in Illinois Californias gas tax rate will now also be adjusted each year to keep pace with inflation.

Natural Gas Prices Forecast 2020 Long Term 5 Years

And the states gas tax as a share of the total.

. Michigans Democratic Gov. Mar 25 2020. With the mid-year tax rate increase gasoline tax revenues were up 2696 million from the prior fiscal year.

A recent study found that in 2020 Michigan collected 317 billion in fuel taxes and. Whitmer is bonding for over 35 billion to finance fixing trunkline roads which have been destroyed by Michigan weather heavy traffic and salt. Gasoline 263 per gallon.

The tax on regular fuel increased 73 cents per gallon and the tax on. Increased Gasoline Tax rate to 19 cents per gallon. Alternative Fuel which includes LPG 263 per gallon.

GASOLINE TAX Collections and Tax Rate 6806 Gasoline tax collections totaled 8666 million in FY 2014-15 yielding 456 million per one cent of tax levied. It will have a 53 increase due to a rounding provision specified in the calculations. 0183 per gallon.

Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax by 73 cents and 113 cents to 263 cents starting in 2017. Gas and Diesel Tax rates are rate local sales tax varies by county and city charged in PPG Other Taxes include a 075 cpg UST gasoline and diesel Hawaii. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. The governor vetoed the Legislatures 375 million increase in road funding in 2019 the year she proposed the tax hike. Gas taxes Created Date.

10172019 105048 AM. For fuel purchased January 1 2022 and after. The 187 cents per gallon state gas tax and the 184 cents per.

Added Chapter 2 Diesel Fuel Tax to 150 PA 1927 at 6 cents per gallon. Cent of tax was 466 million. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline.

An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon. So far in 2021 inflation has been unusually high. Repealed 1947 PA 319.

Increased Motor Carriers Fuel Tax rate to 21 cents per gallon with 15 cent credit for fuel purchased in Michigan. Heres what MDOT says on the issue. That makes the total gas tax nearly 075 a gallon the highest rate in state history.

1 2020 and Sept. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Diesel Fuel 263 per gallon.

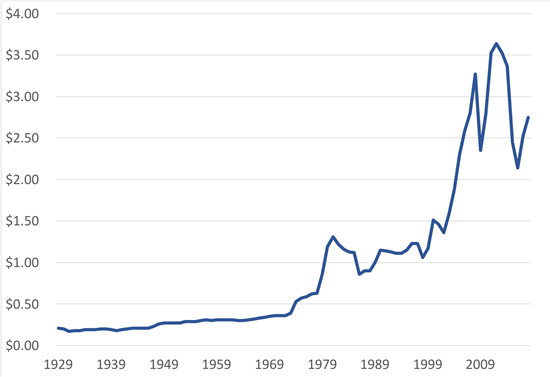

Exhibit 5 Gasoline Tax Revenue millions 0 250 500 750 1000 1250 1960 1970 1980 1990 2000 2010 8666 FY 2015 9389 FY. Effective January 1 2022. Liquefied Natural Gas LNG 0243 per gallon.

The current state gas tax is 263 cents per gallon. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. Both taxes will automatic increase with inflation in 2022 and every year.

In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. In Michigan three taxes are included in the retail price of gasoline. Gasoline 272 per gallon.

As of January of this year the average price of a gallon of gasoline in Michigan was 237. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. Michigan gas tax increase history Monday April 25 2022 Edit.

Voters were asked to repeal the 2017 law last year at the ballot box but they decided to keep the reform intact by a margin of 57 to 43 percent. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. Didnt gas taxes just go up.

Whitmer failed in her push for a 45-cent-per-gallon gas tax increase which the governor claimed would raise an estimated 25 billion. Increased Gas Tax rate to 45 cents per gallon. 1 2017 as a result of the 2015 legislation.

The goal Whitmer said is to generate about 2. The Legislatures recently passed 2022-23 budget provides 203 million more in state funding for. The current state gas tax is 263 cents per gallon.

Federal excise tax rates on various motor fuel products are as follows. Inflation Factor Value of Increase Percentage. Diesel Fuel 272 per.

Michigan fuel taxes last increased on Jan. The same three taxes are included in the retail price on. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

Exhibit 5 provides a 56-year history of collections. For fuel purchased January 1 2017 and through December 31 2021. The increase is capped at 5 even if actual inflation is higher.

If Whitmers plan for a tax increase had been approved Michigan would now have the highest gas tax in America. Effective January 1 2017 the motor fuel rate which applies to both gasoline and diesel fuel rose to 263 cents per gallon. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

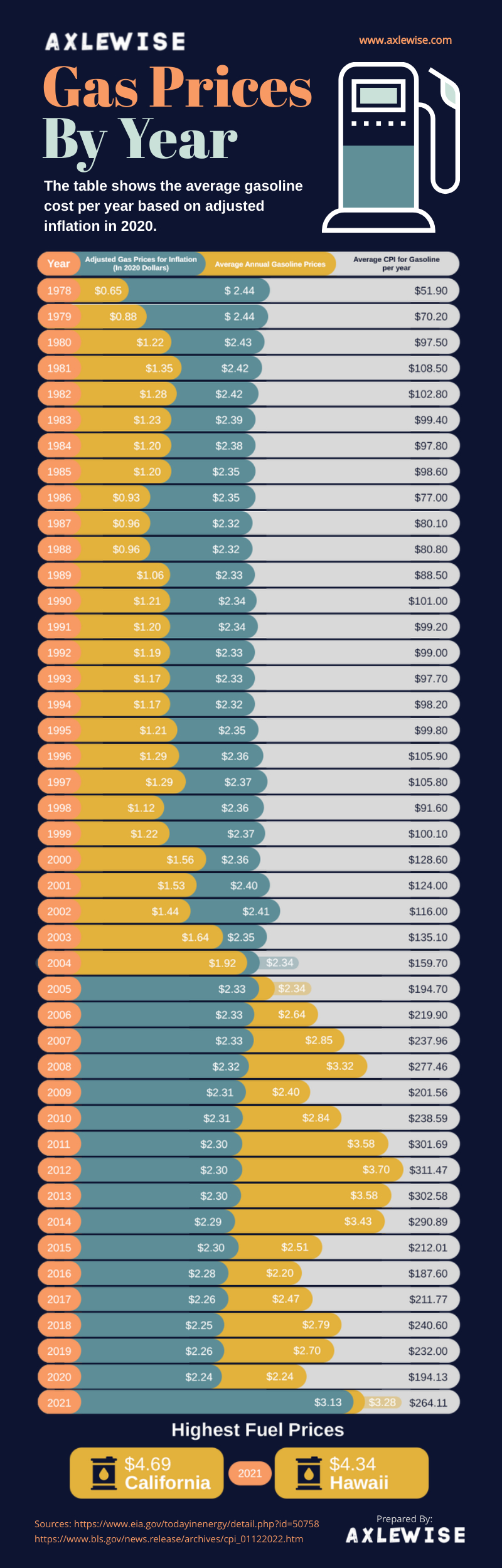

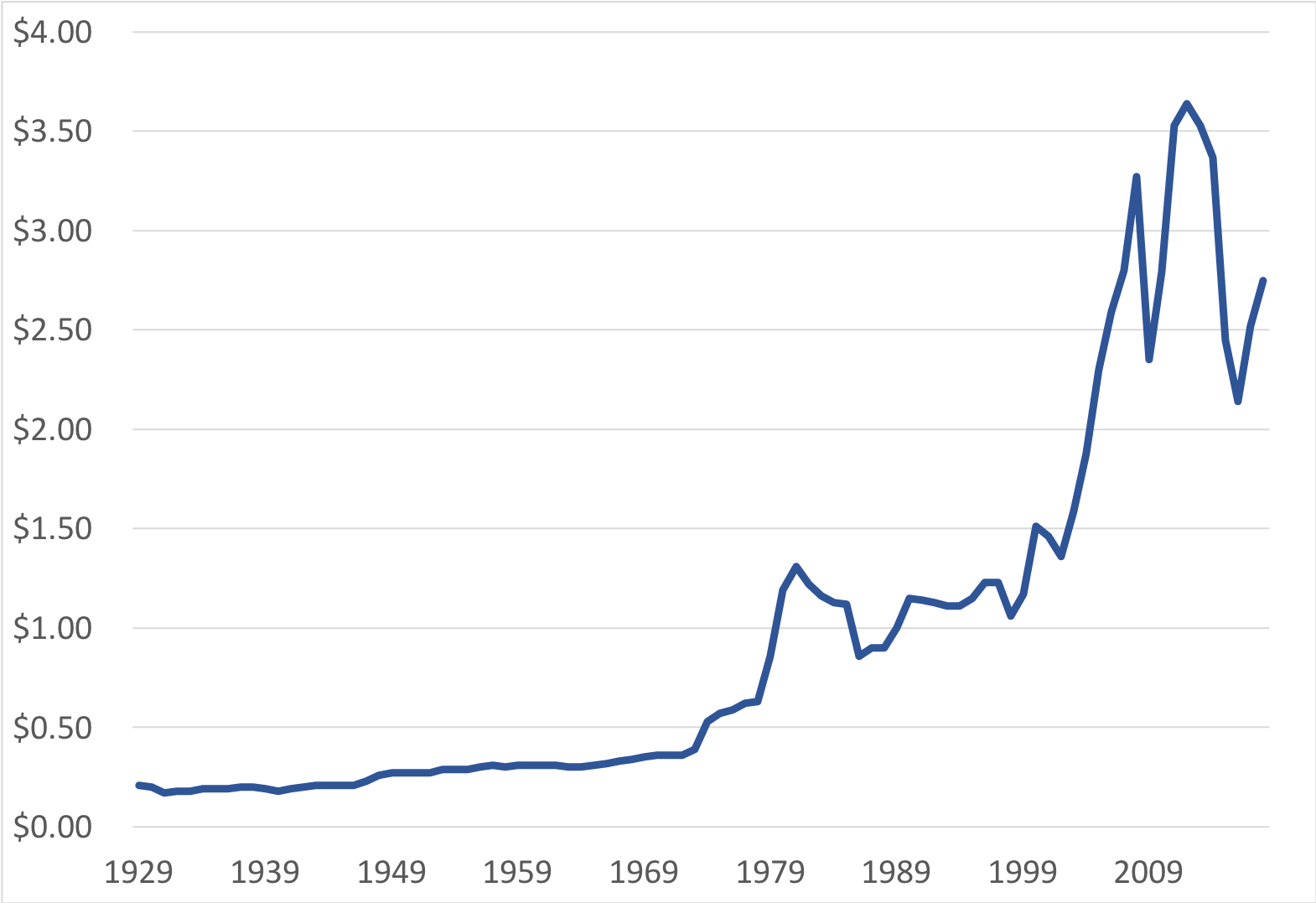

Historical Gas Prices By Year What Affects Them 1978 2022

Michigan S Oil And Gas History Tip Of The Mitt Watershed Council

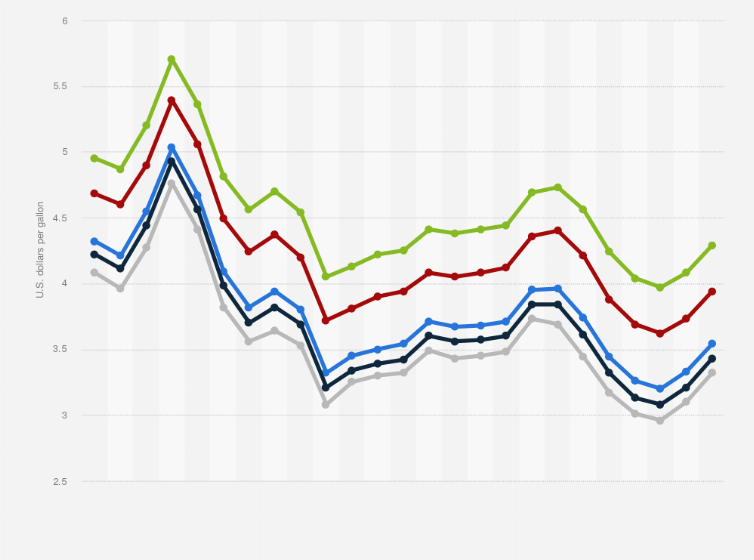

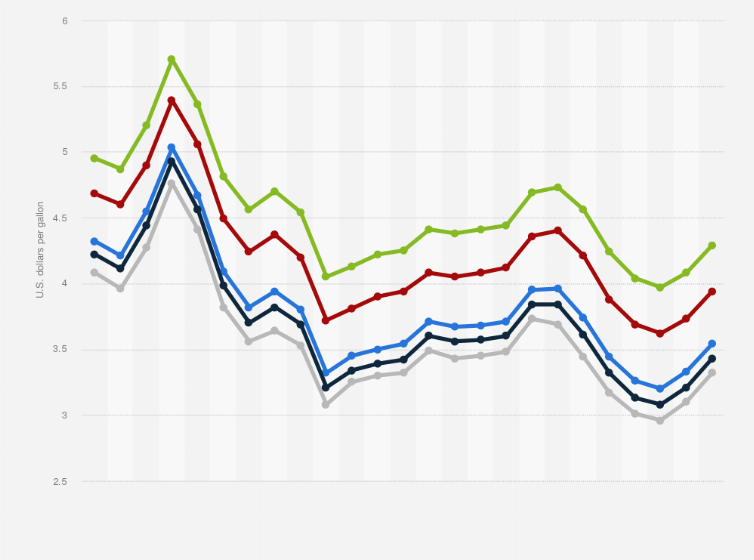

Monthly Retail Price Of Gasoline In The United States 2022 Statista

United States Central Bank Assets To Gdp 2022 Data 2023 Forecast 1960 2020 Historical

What Was The Highest Gas Price In Us History

The Gas Tax S Tortured History Shows How Hard It Is To Fund New Infrastructure Pbs Newshour

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Gasoline Fuel Prices Around The World 2021 Statista

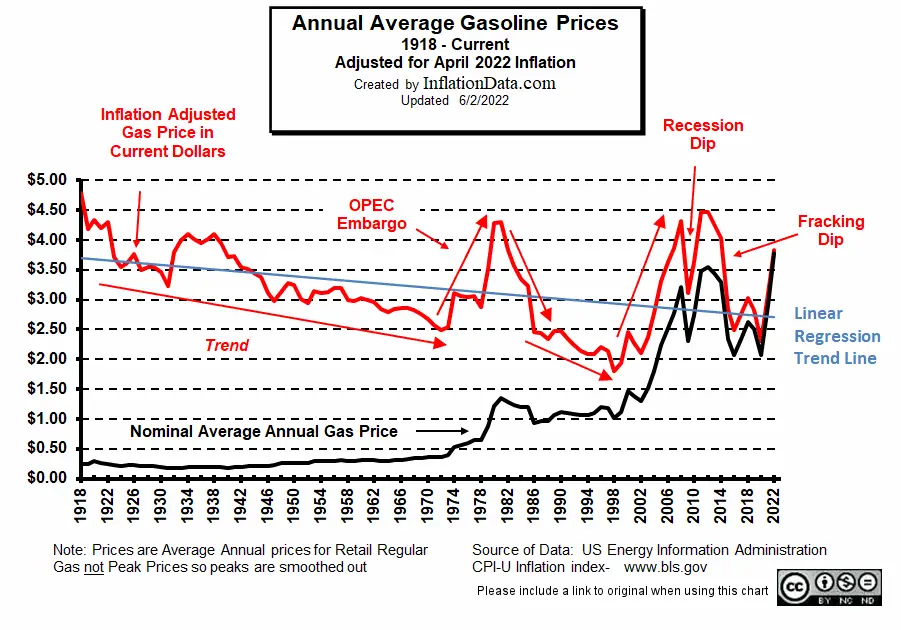

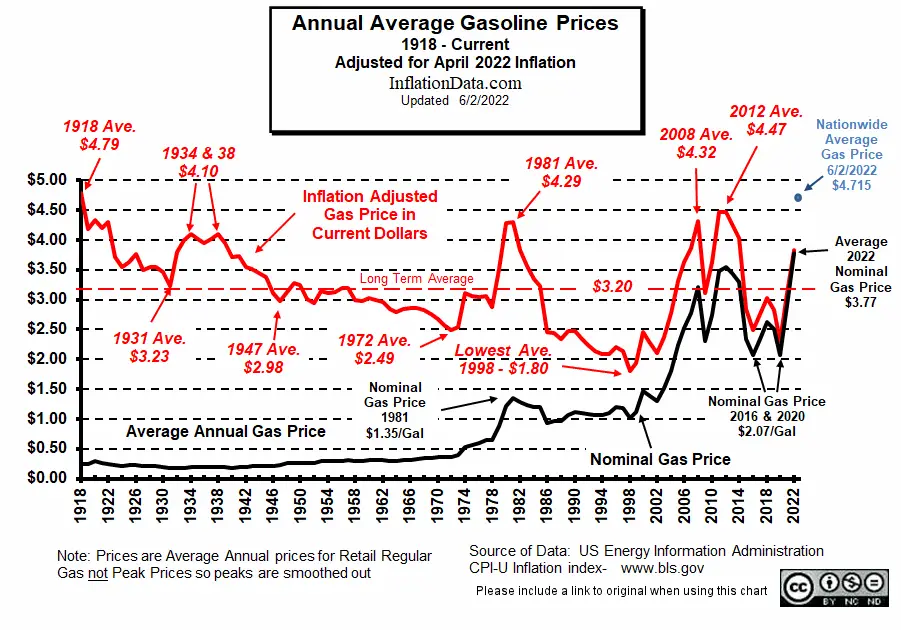

Inflation Adjusted Gasoline Prices

Gas Price History List Of Prices By Year

Gas Price History List Of Prices By Year

Which President Oversaw The Highest Gasoline Prices

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Indiana Gas Tax Increases By 10 Making It Highest In State History Abc7 Chicago

Why Gasoline Prices Remain High Even As Crude Oil Prices Fall The Washington Post

Inflation Adjusted Gasoline Prices

Gas Prices How The Cost Per Gallon Has Changed Throughout Us History